The smart video intercom market is growing faster than ever. With cities expanding, and people caring more about security, distributors who jump on this trend now can grab a big slice of the pie. In this post, we’ll break down the latest market stats, key growth trends, and real-world ways distributors can boost their product lineup and profits in 2025 and beyond.

Market Overview & Growth Trends

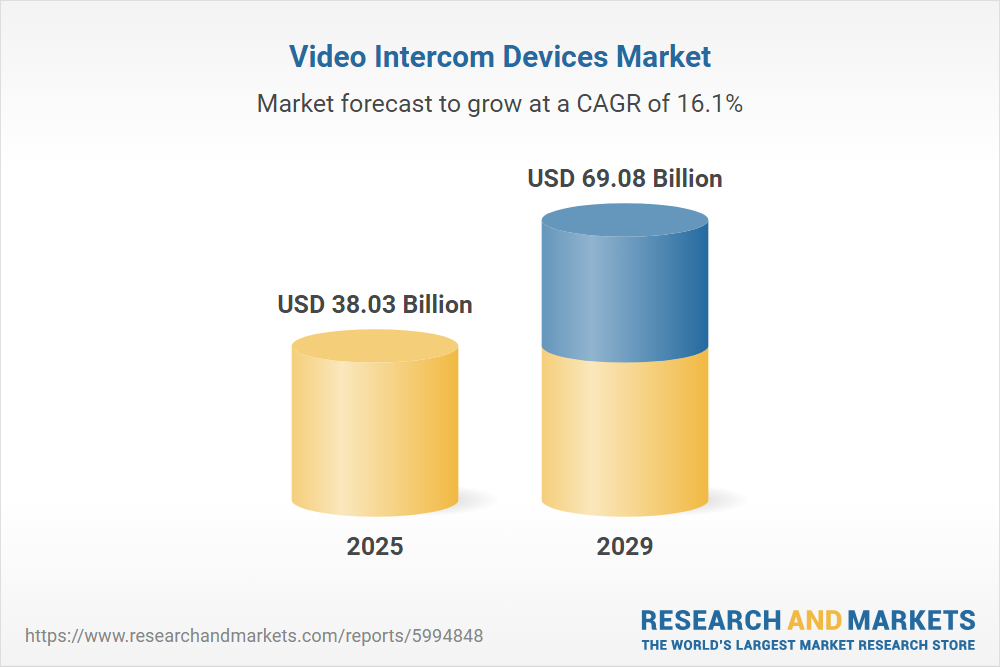

In 2024, the global smart video intercom market reached an estimated USD 25.8 billion and is projected to grow to USD 106.5 billion by 2034, representing a CAGR of 15.8% (GMI Insights).

Other research shows that the market was valued at USD 26.97 billion in 2023 and is expected to hit USD 66.3 billion by 2030, at a CAGR of 11.9% (Verified Market Research).

Regional Highlights (2025 estimates):

Europe: USD 6.75 billion (over 30% of global share) – Strong demand in residential complexes and commercial projects.

Asia-Pacific: USD 5.18 billion – Driven by rapid urban development and increasing middle-class spending.

India: USD 621.4 million with a remarkable CAGR of 18% – One of the fastest-growing security product markets globally (Cognitive Market Research).

Key Growth Drivers:

Integration with smart home ecosystems.

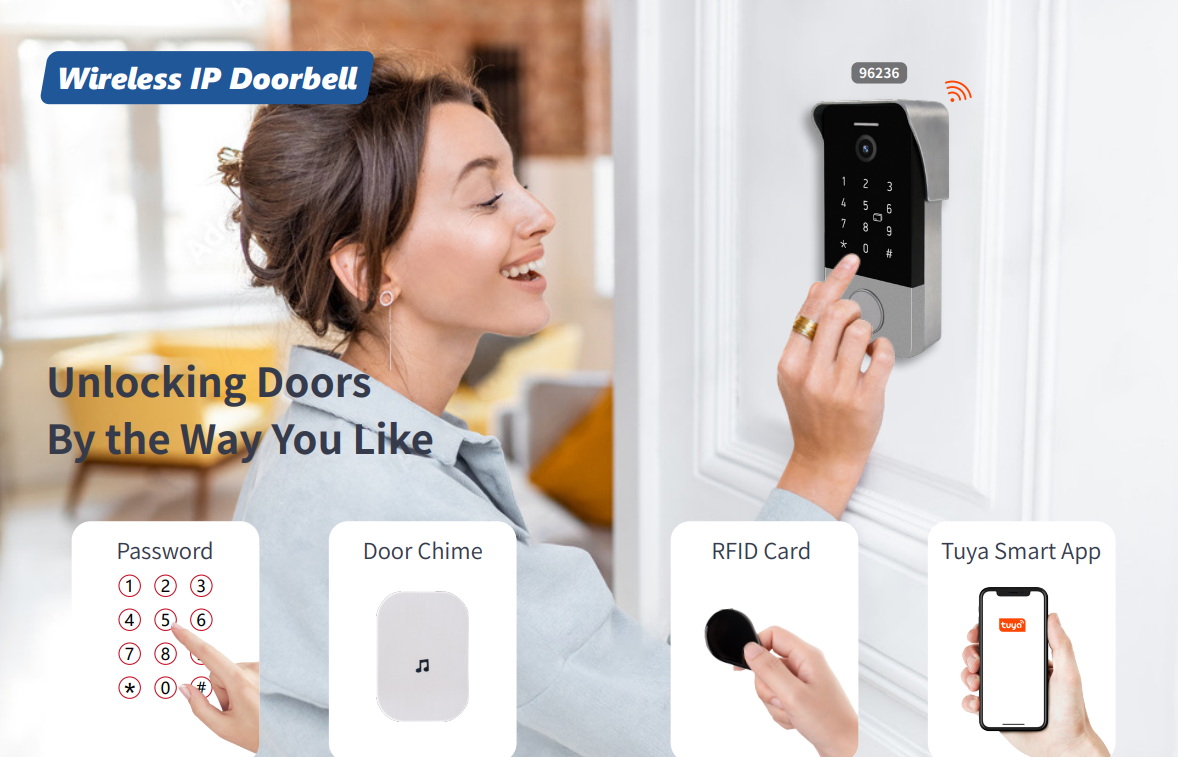

Transition from traditional wired intercoms to IP-based, feature-rich systems.

Rising security concerns and demand for touchless visitor management.

Opportunities for Distributors

Tap into High-Growth Regions

Emerging markets such as India, Southeast Asia, and the Middle East present double-digit growth potential. For distributors, these regions offer early-entry advantages and less saturated competition compared to mature Western markets.

Expand Product Portfolios

Adding smart video intercoms to an existing security product range allows distributors to offer complete solutions, from access control to surveillance. This integrated approach increases project value and customer retention.

Offer Value-Added Services

Beyond product sales, distributors can differentiate through training programs for installers, extended warranty packages, and localized after-sales support. These services build stronger dealer relationships and long-term loyalty.

Case Study: Doubling Sales with Smart Video Intercoms

In 2024, a European distributor specializing in CCTV systems added a mid-range IP video intercom line to their portfolio. By bundling intercoms with existing camera packages and targeting gated communities, the distributor achieved a 200% year-over-year increase in project sales, while also securing exclusive supply agreements with two major property developers.

Strategic Recommendations for 2025

Europe & North America: Focus on product quality, certifications (CE, RoHS, GDPR compliance), and compatibility with popular smart home platforms.

Asia-Pacific & Emerging Markets: Offer competitive pricing, flexible payment terms, and training programs to build installer networks.

All Markets: Explore private label opportunities to strengthen brand presence and lock in customer loyalty.

The smart video intercom market is entering a decade of rapid expansion. Distributors who act now can secure strong positions, benefit from early-mover advantages, and capitalize on rising demand for connected security solutions.

If you’re looking to expand your portfolio with high-quality smart video intercom systems backed by a proven manufacturer, contact us today to discuss distributor pricing, private label options, and regional partnership programs.